Massachusetts offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Energy

Renewable and Alternative Energy

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Massachusetts State House

24 Beacon St., Room 1,

Boston, MA 02108

Phone: (617) 722-2000

Fax: (617) 727-7700

Hours: M-F 9:00am-5:00pm

National Grid

939 Southbridge St,

Worcester, MA 01610

(800) 322-3223

Hours: M-F 7:00am-7:00pm

Energy Division

Massachusetts Department of Energy Resources

100 Cambridge St., 9th Floor

Boston, MA 02114

Phone: (617) 626-7300

Email: [email protected]

Hours: M-F 8:45am-5:00pm

Boston/Norton Weather Bureau

46 Commerce Way

Norton, MA 02766

Phone: (508) 622-3250

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Residential Energy Credit | Approx. $1000 | All renewable energy source expenditures made by an owner or tenant with respect to his or her principal residence |

| Sales Tax Exemption | 6.25% | Single use sales tax exemption for renewable energy equipment |

| Property Tax Exemption | 100% for 20 years | Property tax on the increase in home value from renewable energy upgrade |

| Solar Massachusetts Renewable Target (SMART) | varies per location and size of system | Homeowners served by the three largest utilities in the state |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Massachusetts Clean Energy

Residential Energy Credit

Incentives

Long-Term Contracts

Net Metering Guide

MOR-EV Rebates

Power Outage Map

Massachusetts Department of Energy Resources

100 Cambridge St., 9th Floor,

Boston, MA 02114

Phone: (617) 626-7300

Email: [email protected]

Monday – Friday

8:45 AM – 5:00 PM

DOER SMART Program

[email protected]

DOER RPS Program

[email protected]

Stretch Code

[email protected]

Solar Credits in MA Overview

The Bay State offers direct and indirect Massachusetts solar incentives from the federal and state governments. This is one of many reasons MA is one of the top states for solar energy in the United States.

Residents and businesses can take advantage of these incentives, and there are financial reasons to do so. Solar energy can save money.

Multiple energy companies like National Grid were forced into a position where 64 percent of customers saw their energy bills increase in November 2022.4 Solar energy can offset such utility increases by reducing your energy costs and making you independent from the grid.

This comprehensive guide outlines the available Massachusetts solar incentives and other solar power information for the state, as well as the steps for open enrollment for residential solar incentive options at both the state and federal level.

Programs That Massachusetts Is Using To Make Solar Panels Affordable to Residents

Primary incentives in Massachusetts for solar energy include tax credits and exemptions; both of which help residents save in different ways.

These incentives also paved the way for Massachusetts to become one of the states to have a high electricity capacity for solar energy, ranking number 11 among the 50 US states for solar adoption.

Here is a list of available programs in Massachusetts:1,2

- Solar Massachusetts Renewable Target: SMART

- Residential Renewable Energy Income Tax Credit

- Property and Sales Tax Exemptions For Solar Installation

- The Federal Solar Investment Tax Credit (ITC)

Massachusetts Residential Renewable Energy Income Tax Credit

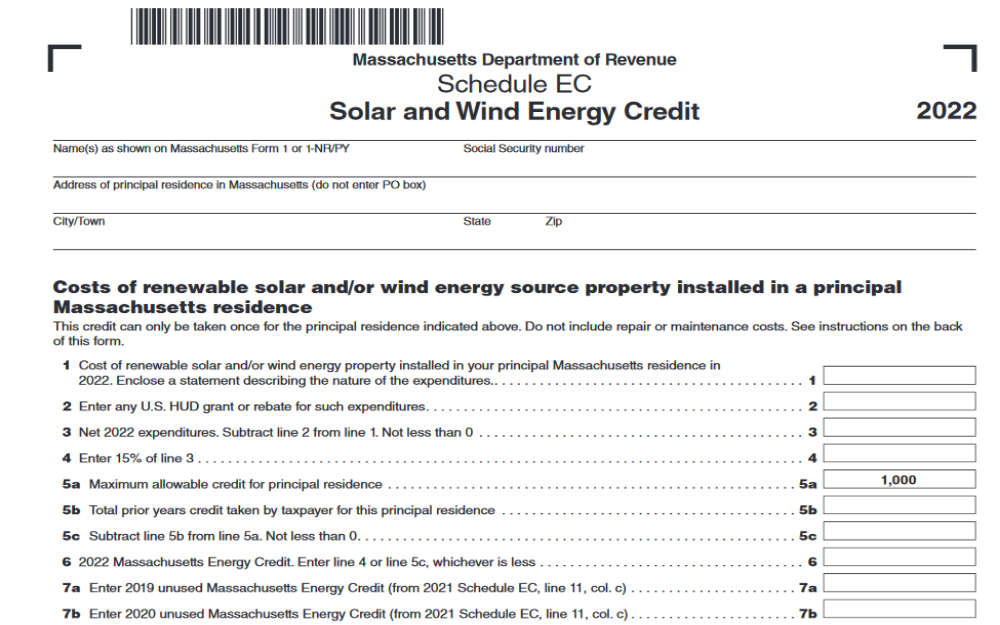

Massachusetts’ tax credit is listed as 15% of the system cost presented against an individual’s income tax up to a $1,000 credit.8

How Solar Credits Work With Taxes

Tax credits represent a dollar-for-dollar amount taxpayers can claim.6 This reduces how much tax they owe.

Ultimately, this will diminish annual tax liability for those eligible. Tax refunds may be potentially increased.

We’re going to explore each solar credit option. There are websites that you can check to see a list of renewable options in Massachusetts.7

The following incentives are available for Massachusetts residents.

Solar Massachusetts Renewable Target: SMART

SMART helps to power solar energy across MA. It’s a tariff-based incentive.

This is paid to utility companies that serve those who own solar energy systems. Eligibility requires a successful application.

To translate that: the utility company pays the system owner if they qualify.9 So if you make “the grade,” you get paid.

Property and Sales Tax Exemptions for Solar Installation

Under this incentive option, not only property tax is exempted, but so is sales tax. For 2023, sales and use tax is not applied to any sort of “renewable energy” equipment, and that includes solar.

That means you could save $6.25 for every $100 spent, or $937.50 for a $15k purchase. There is no increase in property value taxes owing to expanded value from solar energy installation.

Basically, solar energy won’t be added to the property tax assessment, as it’s exempt.

Moreover, some buyers are willing to pay up to $15k more for a home with solar energy (which is about the cost of a solar system, depending on it’s age).5

So on many online realtor locations, you can ask for a higher price from buyers, and be more likely to get it, without being obligated by law to pay a higher tax for that increased value.

The larger your property, the greater the potential savings here. This exemption is available for 20 years.10

Additional Massachusetts Renewable Energy Incentives

In addition to solar incentives, Massachusetts offers a number of clean energy rebates and credits, provided by both local governments and state wide utility providers.

| Massachusetts Solar Incentive | Rebate Amount | Conditions | Contact |

| CMLP Solar PV Rebate | $625 per kW (DC), capped at $3,125 |

|

Pamela Cady

Concord Municipal Light Plant |

| TMLP Solar Rebate Program (PV system and battery storage) | PV system: $1.50 per watt, capped at $4,500 |

*The Solar Rebate Application form must be submitted along with copies of paid invoices. |

Mail the required forms and documents to: TMLP Solar Rebate Program, PO Box 870, Taunton, MA 02780-870 |

| Battery Storage: $300 |

*Accomplished Battery Backup Verification, Inspection and Rebate Application form with

|

||

| RMLD Residential and Small Commercial Solar Rebate Program | $1,200 per kilowatt, capped at ≤ 50% of installation costs excluding taxes |

*100% of RECs produced by the system will be given to RMLD as long as the system works. |

Send required documents when applying for interconnection to: [email protected]

All other documents should be submitted to the Online Rebate Portal |

| Hudson Light & Power Photovoltaic (PV) Incentive Program and Additional Renewable Energy Rebates | $1.20 per watt (DC), capped at 50% of the system price or up to $7,500 | Various conditions and agreements required for interconnectivity. | |

| Small and large appliances, $250-$1750 per customer, per year. | |||

| Wakefield Municipal Gas & Light Department

(Additional Solar and Renewable Energy Rebates) |

Solar Rebate Program: $1.20 per watt from cost of solar system |

|

Submit all documents to WMGLD at [email protected]

For more information and list of additional documents, see the |

| Battery Storage Program: $100/kWh |

|

email [email protected] or call 1-413-308-1311 | |

| SELCO Solar Rebate Program | $0.10 per watt, capped at 25% of cost of solar panel system or up to $1,000 |

|

Website |

| Town of Ipswich Electric Light Department Solar PV Rebate Program | $0.30/watt, capped at $3,000 | Requirements for solar rebate and interconnection are detailed in the Distributed Generation Net Metering Policy. | Website |

The Federal Solar Investment Tax Credit (ITC)

For national solar energy credits, there’s ITC. ITC stands for Investment Tax Credit, and there are multiple varieties available.

In reference to solar energy in MA, ITC refers to an option that started in 2006 and was recently renewed as of 2022 through the “Inflation Reduction Act”.

In a nutshell, ITC provides a 30% tax credit for individuals who are in the process of installing residential solar systems. Commercial and large-scale solar installations are also eligible for tax credits under ITC, though under different percentage breakdowns.11

Does Massachusetts Offer Net Metering and Power Purchasing Agreements (PPA)?

Selling solar power to generate income is net metering. This allows you to be paid if you produce more energy than you can use.23

This is an additional means of increasing savings through solar. A large enough array can pay for itself in net metering over time.

You may be eligible for a Power Purchase Agreement or PPA.24 Primarily, PPAs are commercial, as there tends to be a higher front-end investment involved.

Many businesses lean into PPAs to enhance operational savings over time.

Depending on the grid-based energy source you use in MA, there are various net metering options.25 Current rates will depend on the company you use.

Essentially, companies offer credits for between 8 and 466 MW (MegaWatts) of additional energy generated; each MA energy producer has a “cap” for a region. So you may or may not be able to fully participate, depending on the cap of a given energy provider in your region, or available providers.

Requirements for Obtaining Solar Credit in Massachusetts

People ask: why are solar panels good for the environment? Grid-based energy seems to say “yes,” but why?

Solar panels provide individualized options putting energy control in a community’s hands more directly, decreasing unwanted waste products, and increasing the precision with which communities manage energy utilities.

Solar recycling and component production will need to be optimized for solar energy to reach its peak environmental friendliness. This is why simply having solar isn’t the only prerequisite for benefits.

Not all solar arrays are the same. Standards must be met to obtain solar credit in MA.

- For the SMART program, you need to be involved with either Eversource, National Grid or Unitil. The SMART program is essentially a net metering solution, though what you make monthly may be dependent on local factors of your community.

- For the residential renewable energy income tax credit of 15%, the said 15% claimed can’t exceed personal income tax liability in the year an array is installed.

- MA automatically exempts property owners from additional taxes related to equity from solar arrays added to a home, so you don’t have to do anything except do a good job during installation to qualify for this.

- To qualify for ITC, the Investment Tax Credit, you just have to properly install a solar energy array that generates electricity for your home. The system needs to be installed in the tax year where you factor in the ITC credit.

Solar panel electricity needs to be reliably generated, and you’ll need to familiarize yourself with terms like “solar units”. Basically, these are “blocks” of solar energy generated by a given system.

So 1kWh is a solar unit describing 1,000 Watts of solar energy. For the sustainability of solar energy to be reliable, a lot of panels tend to be necessary.

This is why for most solar panels renewable energy is more consistent when panels are larger. This also means they tend to be more expensive.

On the “paperwork” side of things, in MA you’re going to need to fill out a “Massachusetts Department of Revenue Schedule EC Solar and Wind Energy Credit” form.26

Step 1: Obtain the Form: Download Schedule EC from the Massachusetts Department of Revenue (DOR) website or obtain a copy from your tax preparer or tax software if you’re using one.

Step 2: Provide Basic Information: In Part 1 of Schedule EC, you’ll need to provide your personal information, including your name, Social Security Number, and address. Ensure that this information matches what you’ve entered on your Massachusetts state income tax return.

Step 3: Complete Your Tax Return: Finish filling out the rest of your Massachusetts state income tax return, including all other required schedules and forms.

Step 4: File Your Tax Return: File your Massachusetts state income tax return, either electronically or by mailing a paper return to the address provided in the tax instructions.

For federal tax cuts, you’ll need to attach a 5695 “Federal Energy Credits” form to your 1040.27 You can apply for the SMART program online, which consolidates signups for multiple utility companies in one place.28

What Materials and Parts Do You Need for Solar Panel Systems? Daily Sunlight Hours in Massachusetts

To get an idea of what you’ll need for a solar array at your property, it’s best to answer these questions: What does a solar panel do, and what is a solar panel made of?

Solar energy materials and solar cells that constitute them convert solar energy to electricity. Beyond electricity, heat is also produced.

Silicon, or other semiconductors,12 are used to capture and “translate” solar energy into electricity. Semiconductors release electric charges.

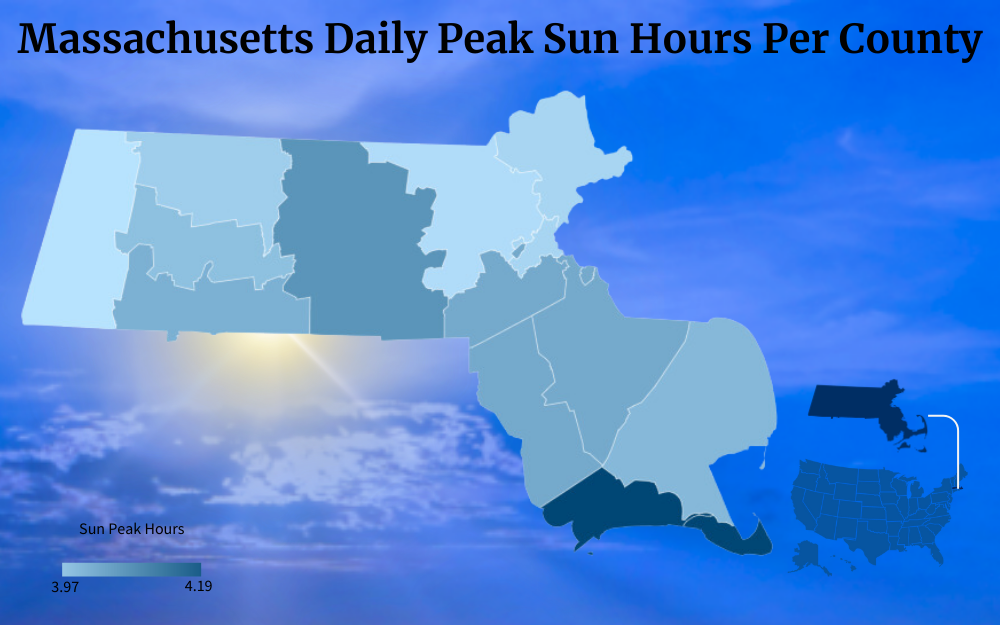

The energy produced by the arrays depends on how much sunlight your location gets.

At a minimum, you’ll need panels, cords that send electricity from those panels, power inverters, surge protectors, and solar battery arrays. You’ll also need equipment to mount panels.

For further context, some websites offer an in-depth explanation of the solar panel components.13

With an array installed, how long are solar panels good for? Well, some estimates say you can get 25 to 35 years from a given array,14 though it’s wiser to assume about 10 years.

There will be some level of maintenance required for best results. Often it isn’t just panels that need to be serviced, but associated inverters or other equipment.15

Between solar materials and installation, you can get a pretty good idea of what real costs will be in Massachusetts. It’s best to plot out costs in a range.

MA expenses should put the total cost of a 5 kWh (kiloWatt hour) system at between $15,130 and $20,470, depending on property characteristics. To break that down, you’re looking at $3.03 to $4.09 per Watt.

So a 1kWh system would be $3,030 to $4,090. Experts say you may be able to earn your investment back with such a system in MA relatively quickly.

The average for ROI here is 8.32 years.16

Solar Calculator: How Much Can You Save by Installing Solar?

Tax incentives often cover panels, cells used for attic fans, contractor labor costs, permit expenses, inspection costs, other equipment requirements (including storage batteries), and associated sales tax.17 You may also want to factor in the disposal of solar panels.

For the most part, you take expired panels to a glass recycler; some may even offer monetary tokens for the effort, depending. Solar recycling as a whole is in its infancy.18

MA households averaged 500 kWhs a month in 2022.19 The 2022 Electricity costs per kWh in MA were 20.47 cents.20

That’s $102.35 a month at an average of 500 kWh, or $1,228.20 a year. A 5kWh solar array can produce an average of 600 kWh a month.21

That alone would save you $1,228.20 annually. Your property’s value may increase on average $15k+ with a new solar array, so right there you offset expenses through equity and energy savings.

With the renewable energy income tax credit, you can save another 15% on home solar installations up to $1k. That means until you spend $6,600, you cut 15% of expenses directly.

After that, cap savings at $1k. You can also claim a 30% tax credit through ITC.

Since sales tax is extracted for renewables in MA, what would have been $20k with such taxes becomes $18,750 without. State tax credits up to $1k would drop that to $17,750.

Federal tax incentives at 30% mean you can cut taxable income down $6k for a $20k array, so that’s another few hundred you’ll save ($600 to $2,220, depending on your tax bracket).22

Most property tax in MA is 1% to 2%, depending on location. A home worth $200k with $15k added equity would generally be taxed at $2,150 to $4,300 a year.

That home would save $150 to $300 a year in property taxes with a solar array while enjoying the same equity; so that’s $3k to $6k over 20 years. Add $15k of equity to tax savings and energy savings, and you’re looking at a non-taxable increase of $1,120.70 to $1,201.70 a year in a span of over 20 years.

For a $200k MA home, if you were able to install a solar panel array at $15k, after incentives and other savings, you’d be looking at a cost of:

- $11,371.16 in the first year

- $7,224.47 at the end of 20 years with equity savings factored in

If you installed the system for $20k, you’d be looking at:

- $16,781.54 after initial savings

- $10,781.54 after 20 years with equity

Expect installation expenses on a $15k to $20k system will be reduced to between $11,371.16 and $16,781.54 after applying incentives in the first year. This is assuming you work with professional solar installation experts and acquire top-of-the-line equipment.

That’s a savings of 16.09 to 24.19 percent.

For energy savings, if you spent $1,228.20 a year, you could potentially save that much annually without changing anything else. If you were able to install the panels cheaply, with incentives, your system will pay for itself in 9.25 to 13.66 years, depending on how you install it.

Going the DIY route provides even more savings, as you can mount an array for between $5k and $10k, depending on the equipment you secure. A $5k solar array could pay for itself in four years while expanding equity.

The most profitable move would be to install solar going the DIY route, save with it for several years, and then sell the property with increased equity to maximize potential earnings. However, these numbers are idealized.

Expect 16 to 24 percent in direct savings from incentives and credits, and up to 100 percent or more in savings owing to deferred utility bills and added equity. Properly managed, a solar energy array is an investment that can provide a return.

Using Photovoltaic Cells in Massachusetts for the Solar Grid

Photovoltaic solar cells (or PV cells)29 make up solar panels. These are often called solar cells.

PV stands for “photovoltaic”. The term refers to non-mechanical tech which converts sunlight to electricity.

Some PVs can even turn “artificial” light into electricity.

Price isn’t always an indicator of quality. When you’re choosing PV cells, you want to look at more than how much they cost.

It’s germane to read associated product reviews and look at what secondary equipment will cost as well. These things can be complex and time-consuming, a lot of homeowners and businesses elect to purchase panels from professionals and work with them to mount the tech properly.

Massachusetts also sells solar panels. Quality panels installed correctly forestall the majority of solar energy problems.

You shouldn’t just mount panels facing straight up. They need to be at a particular angle in reference to the sun for the greatest amount of energy production.30

Installing panels with solar tracking systems will allow them to follow the sun, increasing the amount of energy captured,31 and reducing overall expenses.

However, some mounting systems are more expensive than the value they provide, so you’ll want to work with installers who can provide the information you need about questions like these, and alternatives to explore.

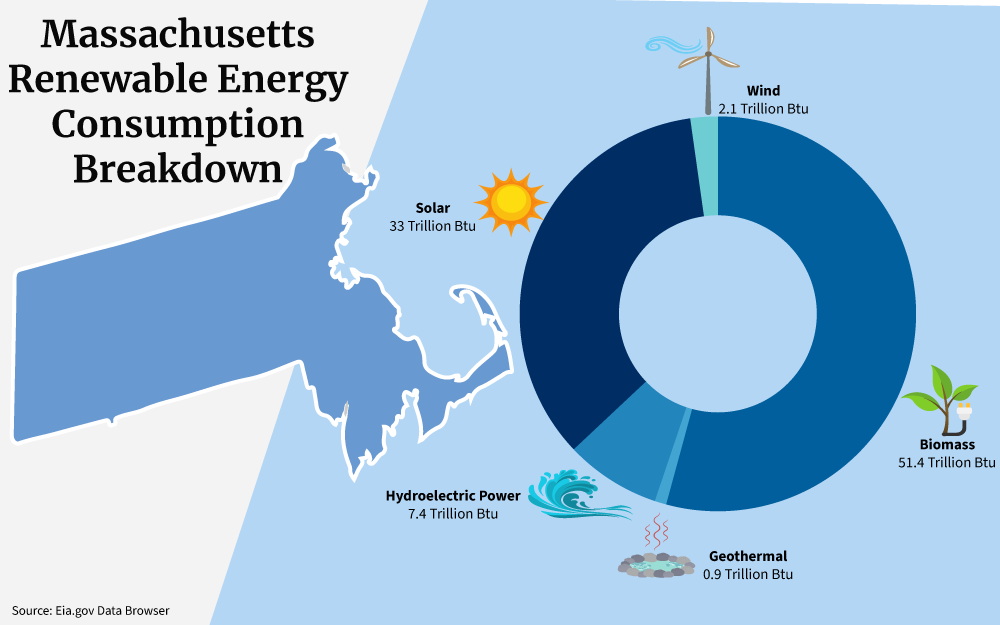

Current Massachusetts Renewable Energy Consumption

Currently, Massachusetts utilizes wind, biomass, geothermal, hydroelectric and solar renewable energy alternatives.

By increasing the number of home solar energy systems, the state can reduce it’s fossil fuel dependence and you can save money.

How Much Electricity Will Solar Provide?

A 5kWh system should produce as much as 20kWh a day,32 or an average of 600kWh a month. Cheaper panels won’t produce as much, and they’ll wear out more quickly.

The cleaner the surface of panels, the better; you’ll want to incorporate cleaning panel surfaces into regular maintenance for best results. Detritus, bird droppings, and more inhibit solar energy collection.

Better panels are less likely to collect dust etc., making them more productive longer.

You can pick up two cheap 500W panels for $320 online, so ten of those would make a 5kWh system and cost about $3,200 prior to installation. Expect another $2k+ in cables, surge protectors, power inverters, cable extensions, battery arrays, shipping costs, and the unexpected.

So if you went totally DIY, you could pick something up for a low cost of $5,200, and install it on your own.

However, such a system will likely malfunction, and you’ll need to sub out panels. It’s better to spend more on the front end and less on the back end.

Ask multiple solar energy installers, and have them go over the numbers with you carefully. A few hours on the phone can save thousands of dollars over the long term, even putting money in your pocket collaterally through cost deferral.

Maybe free solar panels are rare, but if you take full advantage of all credits, metering, and energy savings, panels will quickly pay for themselves and then some. So can you get solar panels for free?

Yes and no. They are not free immediately, but in time, they pay for themselves.

Solar energy is still developing.3 If you put time and effort into establishing a solar energy array on your property, there’s a high chance you’ll see profit without having to change your lifestyle all that much.

Thanks to the lowering cost of solar panels, net metering programs, tax credits and other Massachusetts solar incentives, getting a solar array installed at your home can deliver long term energy solutions and savings.

Frequently Asked Questions About Massachusetts Solar Incentives

What Are Additional Ways Solar Energy Can Help Me Save in MA?

Beyond tax credits, equity enhancement, and energy cost deferral over time, solar energy can put money directly in your pocket as more locals install arrays that help reduce the stress on utilities traditionally reliant on other means of energy production. The more people acquire solar, the greater the net metering opportunities and eventually, solar energy could even be used as a form of cryptocurrency in the mainstream.33

What Is the Average Cost of Installing a Solar Energy Array on Residential Property in MA?

In Massachusetts, installing a 5kWh solar array through a professional service will likely cost between $15,000 and $20,000, while a DIY approach could run at least $10,000 after accounting for incentives and net metering. The final cost varies depending on your choice of panels, installation company, and the complexity of your system.

How Long Do Solar Credits Last in Massachusetts?

In terms of how long do solar credits last in Massachusetts, if you were able to apply for solar metering credits by September 26, 2016,25 and acquire cap allocation by January 8, 2017, then standard metering credits are available for 25 years from the instant your property was first connected to the grid. Those receiving cap allocation after the aforementioned date get 60% of net excess kWhs for the same amount of time and these numbers apply to solar arrays that are not “cap exempt”.

References

1Farney, B., & Saddler, L. (2023, August 16). Massachusetts Solar Incentives, Tax Credits, Rebates and Solar Panel Cost Guide. Forbes Home. Retrieved September 2, 2023, from <https://www.forbes.com/home-improvement/outdoor/solar-panel-pricing-incentives-massachusetts/>

2This Old House. (2023, June 6). Solar Incentives in Massachusetts (2023 Guide). This Old House. Retrieved September 2, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/solar-incentives-massachusetts>

3Chester, M. (2023, August 22). These 10 States Are Leading Solar Energy Installation in 2023. EcoWatch. Retrieved September 2, 2023, from <https://www.ecowatch.com/solar/states-leading-solar-energy-installation>

4Fortin, M. (2022, December 5). Some Mass. Residents See Utility Bills Triple. Here’s Why Rates Are Skyrocketing. NBC Boston. Retrieved September 2, 2022, from <https://www.nbcboston.com/news/local/some-mass-residents-see-utility-bills-more-than-triple-heres-why-rates-are-skyrocketing/2911487/>

5This Old House. (2023, May 17). Do Solar Panels Increase Home Value? This Old House. Retrieved September 2, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/do-solar-panels-increase-home-value>

6Internal Revenue Service. (2023, April 13). Tax credits for individuals: What they mean and how they can help refunds. Internal Revenue Service. Retrieved September 2, 2023, from <https://www.irs.gov/newsroom/tax-credits-for-individuals-what-they-mean-and-how-they-can-help-refunds>

7DSIRE. (2023). Programs. DSIRE NC Clean Energy Technology Center. Retrieved September 2, 2023, from <https://programs.dsireusa.org/system/program?state=MA>

8EnergySage, Inc. (2023). Massachusetts’ solar rebates and incentives. EnergySage. Retrieved September 2, 2023, from <https://www.energysage.com/local-data/solar-rebates-incentives/ma/>

9Commonwealth of Massachusetts. (2023). Solar Massachusetts Renewable Target (SMART) Program. Mass.gov. Retrieved September 2, 2023, from <https://www.mass.gov/info-details/solar-massachusetts-renewable-target-smart-program>

10Palmetto Solar, LLC. (2023). Massachusetts Solar Incentives Guide – 2023. Palmetto. Retrieved September 2, 2023, from <https://palmetto.com/learning-center/blog/massachusetts-solar-incentives-tax-credits-guide>

11Solar Energy Industries Association. (2023). Solar Investment Tax Credit (ITC). SEIA. Retrieved September 2, 2023, from <https://www.seia.org/initiatives/solar-investment-tax-credit-itc>

12National Grid. (2023, May 16). How does solar power work? National Grid. Retrieved September 2, 2023, from <https://www.nationalgrid.com/stories/energy-explained/how-does-solar-power-work>

13Alternative Energy Tutorials. (2023). 7 Components of Your Solar Power System. Alternative Energy Tutorials. Retrieved September 2, 2023, from <https://www.alternative-energy-tutorials.com/solar-power/7-components-of-your-solar-power-system.html>

14Solar Energy Technologies Office. (2023). End-of-Life Management for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 2, 2023, from <https://www.energy.gov/eere/solar/end-life-management-solar-photovoltaics>

15Glover, E., & Tynan, C. (2023, July 31). How Long Do Solar Panels Last? Forbes Home. Retrieved September 2, 2023, from <https://www.forbes.com/home-improvement/solar/how-long-do-solar-panels-last/>

16EnergySage, Inc. (2023, August 26). Massachusetts solar panels: local pricing and installation data. EnergySage. Retrieved September 2, 2023, from <https://www.energysage.com/solar-panels/ma/>

17Stanger, T. (2023, June 6). How the Solar Tax Credit Works. Consumer Reports. Retrieved September 2, 2023, from <https://www.consumerreports.org/home-garden/alternative-energy/how-the-residential-clean-energy-solar-tax-credit-works-a1771685058/>

18Cooper, S. (2021, July 20). How to Properly Dispose of or Recycle Solar Panels and Equipment. Santee Cooper. Retrieved September 2, 2023, from <https://www.santeecooper.com/global-news/2021/072021-How-to-Properly-Dispose-of-or-Recycle-Solar-Panels-and-Equipment.aspx>

19Commonwealth of Massachusetts. (2023). Understanding your utility bill. Mass.gov. Retrieved September 2, 2023, from <https://www.mass.gov/info-details/understanding-your-utility-bill>

20Warren, T. (2023, September 1). Massachusetts Electricity Prices. Retrieved September 2, 2023, from <https://www.energybot.com/electricity-rates/massachusetts/>

21Energy Report. (2023). Average Cost of Solar Panels in Massachusetts. Energy Report. Retrieved September 2, 2023, from <https://energyreport.us/average-cost-of-solar-panels-in-massachusetts/>

22Smith, J. (2023, February 27). 2022/2023 Federal Income Tax Brackets and Standard Deductions. DoughRoller. Retrieved September 2, 2023, from <https://www.doughroller.net/taxes/federal-income-tax-brackets-deductions-and-exemption-limits/>

23Lawson, A. J. (2019, November 14). Net Metering: In Brief. Congressional Research Service. Retrieved September 2, 2023, from <https://crsreports.congress.gov/product/pdf/R/R46010>

24United States Environmental Protection Agency. (2023, February 5). Solar Power Purchase Agreements. United States Environmental Protection Agency. Retrieved September 2, 2023, from <https://www.epa.gov/green-power-markets/solar-power-purchase-agreements>

25Commonwealth of Massachusetts. (2023). Net Metering Guide. Mass.gov. Retrieved September 2, 2023, from <https://www.mass.gov/guides/net-metering-guide>

26Massachusetts Department of Revenue. (2022). Solar and Wind Energy Credit 2022. Mass.gov. Retrieved September 2, 2023, from <https://www.mass.gov/doc/2022-schedule-ec-solar-and-wind-energy-credit/download>

27Department of the Treasury Internal Revenue Service. (2022). Residential Energy Credits. Department of the Treasury Internal Revenue Service. Retrieved September 2, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

28CLEAResult. (2021). Building a Brighter Future for Massachusetts. MAsmartsolar.com. Retrieved September 2, 2023, from <https://masmartsolar.com/>

29U.S. Energy Information Administration. (2023, May 26). Solar explained Photovoltaics and electricity. U.S. Energy Information Administration. Retrieved September 2, 2023, from <https://www.eia.gov/energyexplained/solar/photovoltaics-and-electricity.php>

30Marsh, J. (2022, September 25). What’s the best direction and angle for my solar panels? EnergySage. Retrieved September 2, 2023, from <https://news.energysage.com/solar-panel-performance-orientation-angle/>

31Lane, C. (2023, January 12). What is a solar tracker and is it worth the investment? Solar Reviews. <https://www.solarreviews.com/blog/are-solar-axis-trackers-worth-the-additional-investment>

32Peacock Media Group. (2023). 5kW Solar System Information And Pricing. SolarQuotes. Retrieved September 2, 2023, from <https://www.solarquotes.com.au/systems/5kw/>

33Freedom Solar LLC. (2023). SOLAR-POWERED CRYPTO MINING: CRYPTOCURRENCY MINING WITH SOLAR PANELS. Freedom Solar Power. Retrieved September 2, 2023, from <https://freedomsolarpower.com/blog/cryptocurrency-mining-with-solar-panels>

34Screenshot from Commonwealth of Massachusetts. Mass.gov. Retrieved from <https://www.mass.gov/doc/2022-schedule-ec-solar-and-wind-energy-credit/download>